Calculation of insurance premiums is a quarterly report, which since 2017, all employers are required to submit. Consider the procedure for filling out the calculation of insurance premiums in the 1C program.

The calculation of insurance premiums essentially replaces the previously presented RSV-1 and 4-FSS in part of Section I, contains information on the calculation of premiums:

In addition, the Calculation of Insurance Contributions provides the calculation of contributions for additional social security for flight crew members and coal industry workers, for which we previously reported in the PB-3 form, as well as the calculation of contributions for the head and members of peasant (farm) households (previously used RSV-2).

The calculation of insurance premiums consists of

Section 1 provides summary data on accrued insurance premiums by type of insurance for the organization as a whole. Section 2 is intended to be filled in for insurance premiums by the heads of peasant (farm) enterprises and is submitted only at the end of the year. Section 3 - personalized information, is filled in for each employee of the organization.

IN mandatory The following calculation sections are presented in order:

The following sections are presented data available to fill them in:

Let's consider filling out the calculation for insurance premiums in 1C using the following simple example:

| Worker | Earnings for 1 sq. 2017 | Contributions to the OPS | Contributions to CHI | Contributions to OSS |

| Afanasiev A.A. | On a salary of 150,000 rubles. | 33 000 | 7 650 | 4 350 |

| Lopyreva L.L. | On a salary of 150,000 rubles. | 33 000 | 7 650 | 4 350 |

| Romashkina A.A, | On vacation at your own expense | 0 | 0 | 0 |

| Romashkin R.R. | Premium for the previous period 10,000 rubles. | 2 200 | 510 | 290 |

| Total: | 68 200 | 15 810 | 8 990 |

To compile the calculation of insurance premiums in 1C, the corresponding regulated report is used, it is included in the category of reports Tax reporting :

For the calculation of insurance premiums, automatic filling is implemented according to the data of the infobase, for this we use the button Fill :

It is convenient to check the calculation of insurance premiums according to the following scheme:

The title page for the calculation of insurance premiums is filled out completely automatically based on the data of the directory Organizations :

If any information on the title page is not filled out, then you should enter them in the directory Organizations and update the calculation by the More button - Refresh(namely update, not reload).

Section 3 of the calculation is filled in by payers for all insured persons for the last three months of the settlement (reporting) period, including in favor of which payments and other remunerations were accrued in the reporting period within the framework of labor relations and civil law contracts, the subject of which is the performance of work, the provision of services, under contracts of the author's order.

The details of the employee must be included in Section 3:

For each insured person, fill in:

For an employee who was on leave for the entire 1st quarter of 2017 at his own expense, Subsection 3.2.1 is not completed, i.e. We transfer only personal data to it.

The category code of the insured person is determined by the type of insurance premium rate used in the organization, as well as whether the employee has the status of a temporarily staying or temporarily residing foreign citizen. For employees of the organization "Apelsin" LLC, the category code is used HP.

In our example Subsection 3.2.1 would be filled in as follows:

Appendix N 1 to Section 1 is filled in in the context of the payer's tariff codes. In our example, the payer's tariff code is 01, which corresponds to the main tariff and the main taxation system:

The breakdown of tariff codes can be viewed by double-clicking on the code with the left mouse button, a form for selecting the payer's tariff code will open with information on the applicable taxation system and insurance premium rate:

Subsection 1.1 provides the calculation of the amounts of insurance premiums for compulsory pension insurance.

The data is given:

In our example, in subsection 1.1, information is filled in:

In the first month, the line with data on the total number of insured persons (line 010) will include all employees, including the dismissed employee who was paid a bonus in January 2017 and the employee who is on vacation at his own expense. In the line showing the number of persons on whose payments contributions are accrued (line 020), there will no longer be an employee who is on leave at his own expense.

In the next two months, the information on the lines will not contain data on the dismissed employee, because. The organization did not make any more payments to him.

To check the information included in the Calculation of insurance premiums, you can use the report Analysis of contributions to funds (in Accounting 3.0 the report is located in the section Payroll and Human Resources - Payroll Reports, in 1C: ZUP 3 - in the section Taxes and Contributions - Tax and Contribution Reports):

Subsection 1.2 provides the calculation of the amounts of insurance premiums for compulsory health insurance.

This subsection contains information on the number of insured persons, the amount of payments, the basis for calculating insurance premiums for CHI and the amounts of calculated contributions themselves.

In our example, according to compulsory medical insurance, the number of insured persons, the amount of payments and the base for accrual will completely coincide with the data on the compulsory medical insurance.

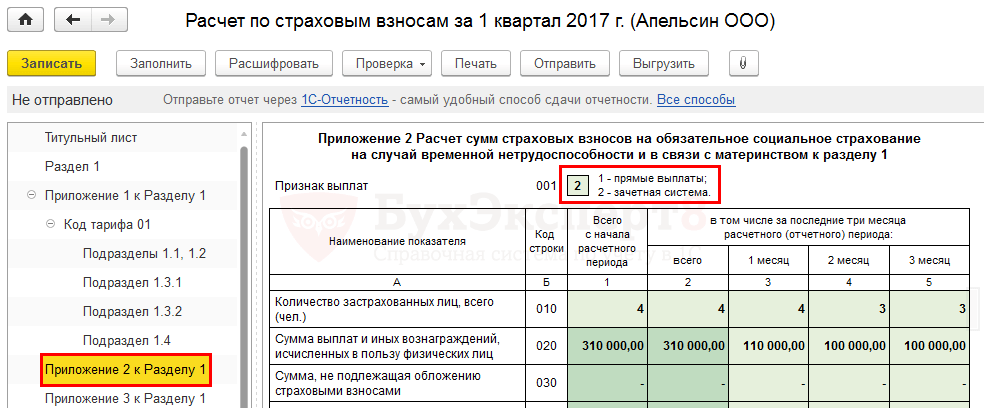

Appendix No. 2 provides a calculation of the amounts of insurance premiums for compulsory social insurance in case of temporary disability and in connection with motherhood.

Appendix N 2 establishes the sign of payments:

In the region in which LLC Apelsin operates, the FSS pilot project does not operate, therefore, in the field Payment sign set to 2.

In our example, for OSS, the number of insured persons, the amount of payments and the base for accrual will completely coincide with the data for OPS and OMS.

Below in Appendix No. 2 there is a table showing the amount of contributions to be paid:

Please note that each amount in this table has its own attribute:

In the organization "Apelsin" LLC, benefits were not paid to employees, therefore, this attribute has the value 1 everywhere.

Section 1 shows summary data on the obligations of the payer of insurance premiums for OPS, OMS and OSS in the context of the CCC.

By default, Section 1 is filled in according to the infobase data. If manual changes are made to the Annexes to Section 1, in order for Section 1 to be filled in according to the data of manual changes, you must use the link Complete Section 1 according to applications .

This completes the calculation of insurance premiums for our example.

With button Examination — Check unloading you can check the main errors of the uploaded data (for example, the presence of passport data, SNILS employees).

The control ratios for the Calculation of insurance premiums were sent by Letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 N BS-4-11 / 4371@. In total, more than 300 control ratios are provided.

What is checked by the control ratios:

"Mathematics"- compliance of indicators by amounts. In particular, an important control ratio must be met: the amount of contributions to the CPE for each employee from Section 3 must be equal to the sum of the contributions to the CEA from Subsection 1.1 for the whole organization. If this ratio is not met, then the tax calculation will not be accepted. When submitting subsequent reports, starting with the report for the half year of 2017, it is also necessary to check that the indicators of the current report are aligned with the indicators of the report submitted in the previous period.

Personal Information insured persons: full name, SNILS. The reconciliation will go with the information contained in the tax TsUN AIS database. If the information in the tax database does not match the calculation data, the taxpayer will be denied acceptance of the calculation. Therefore, it is necessary to carefully check the personal data of employees and, if necessary, provide explanations to the supervisory authority.

Reconciliation with 6-personal income tax. The following control ratio must be met: the amount of accrued income of the taxpayer, with the exception of the amount of accrued income on dividends in 6-personal income tax >= the amount of payments and other remunerations calculated in favor of individuals in the RSV:

Often this control ratio may not be fulfilled for various objective reasons:

However, if this ratio is not met, you must be prepared to provide written explanations to the tax office.

We are considering a very simple example, so for our example, this control relation holds:

To check the "mathematics" in the downloaded calculation of insurance premiums, you can use the free program Taxpayer legal entity(posted on the website www.nalog.ru). First you need to upload the calculation of insurance premiums by command Service - Receiving reports from magnetic media, then open the calculation and click on the button Document control.

Hello dear blog readers. In today's publication, I will continue a series of articles for novice users of the software product "1C Salary and Personnel Management", as well as for those who are just deciding whether to purchase this program or not. And today we will talk about the formation of regulated reporting for submission to regulatory authorities: the Social Insurance Fund (4-FSS), the Pension Fund of Russia (RSV-1) and the Inspectorate of the Federal Tax Service (NDFL). It seems to me that this section of accounting is the key and final in working with the program. In many ways, it is for the sake of automating the formation and sending of reports that this program is purchased.

Let me remind you that earlier in this series of articles, the possibilities of personnel accounting, calculation and payment were presented. wages, calculation and payment of insurance premiums, as well as the possibility of accounting in 1s zup. A list of all materials in this series is presented below:

✅

✅

✅

So, let's start with the 4-FSS report. This report is submitted to the Social Security Fund on a quarterly basis. To generate this regulated report, you need to go to the workplace “Regulated and Financial reporting” (Payroll for organizations -> Reports -> Regulated reports). In the left column of the window that opens, you must select the type of report "4-FSS" and double-click on it to create a new one.

This will open an empty Form 4-FSS. To automatically fill it out according to accounting data, you must click on the "Fill" button located in the upper left corner. To navigate between sections, use the bookmark buttons or the "Go to ..." button.

It is also possible to edit the form manually.

After filling in and verifying the information, click OK. The generated report will appear in the Report Log of the Regulatory and Financial Reporting workplace. This report will be saved in the database like any other document in the program.

The created report can be printed using the "Print" button in the report itself or in the Report Log. Then, the report can be downloaded in XML format to be sent to the regulatory authorities using third-party programs (For example, SBiS). For users who have "1C Reporting" connected, it is possible to directly send a report from 1C ().

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step-by-step instruction for beginners:

Since the 1st quarter of 2014, the format of regulated reporting to the Pension Fund has changed. Now organizations must provide a single form of RSV-1. Which will contain individual information of employees. Read more about updates in RSV-1 in the articles:

There are two ways to generate a RSV 1 report. The first one is generating a report in the workplace “Preparing data for transfer to the FIU”. It can be accessed on the PFR tab of the program desktop. The second way is to open the “Regulated and financial reporting” service (Payroll by organizations -> Reports -> Regulated reports) and double-click on the line RSV-1 in the left column. At the same time, the program will still redirect you to the “Preparing data for transfer to the FIU” workplace.

As you probably already understood, pressing the "Generate" button will help us create a report for the 1st quarter of 2014.

A detailed description of all fields of this form is given in the article:. The distribution of paid contributions is cancelled. The workplace provides the ability to edit only sections 2.5 and 6 of the RSV-1 form. To edit the remaining sections and view the RSV-1 as a whole, you need to go to the “Regulated and Financial Reporting” service (Payroll for organizations -> Reports -> Regulated reports). The RSV-1 report created by us will be displayed in the Report Log. After opening it, you can edit and view all sections, as well as print, upload and send to the pension fund.

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

To generate reports to the tax office in the form of 2 personal income tax, which is submitted at the end of the year, there is a special processing in the program "Preparation of personal income tax data for transfer to the tax authorities." It can be accessed on the "Taxes" tab of the program's desktop. Using the "Generate references" button, data on tax accounting. The generated information can be checked using the built-in check, print out the certificates for each employee and the register of income information, upload a file for sending in XML format. If you have the 1C Reporting service connected, reporting can be sent directly from the program (read). The buttons for performing these actions are circled in red in the picture.

For correct uploading of data, it is necessary that employees enter passport data and registration information. All this is entered in the directory "Employees". In general, the program will tell you about all the missing information when you try to upload data.

That's all for today. In the next part, we'll look at .

To be the first to know about new publications, subscribe to my blog updates:

How to generate PFR reporting in the 1C 8.3 Accounting program?

Consider how the 1C Accounting 8.3 computer program helps an accountant make quarterly reports to the FIU.

If the necessary documents were entered into the 1C system in a timely and correct manner, then the formation of “pension” reporting is not difficult, since it is performed automatically. In order for all the data to get to the right places in the reports, the following operations must be entered in 1C.

When the documents on accrual and payment of contributions are successfully entered into the program, you can start generating reports to the Pension Fund. In 1C, a workplace serves for this purpose:

Salary and personnel / Insurance premiums / Quarterly reporting to the Pension Fund

To create a new set of reporting bundles, just set the current period and click "Create a set" (the period on this button will be indicated automatically).

If the 1C 8.3 program has previously created and saved sets for other periods, then they are displayed in the list. Moreover, the creation of a new set of forms is possible only if the earlier sets have the status “Sent” or “Will not be transmitted”. To change the state, use the "Set state" link.

By pressing the "Create Kit" button, the program creates and automatically fills out the RSV-1 form. The window that opens displays general information about the taxable base and accrued contributions for the required period. The status of the form is "In Progress".

Section 1 includes the amounts of contributions to the PFR and FFOMS that were accrued and paid during the period, as well as the debt (if any).

Section 2 reflects the calculation of contributions on the basis of the taxable base and the applicable tariff. If during the period the program introduced the documents "Sick leave" for which benefits were accrued, then the amount of benefits will automatically be reflected in section 2 in lines 201 and 211 "Amounts not subject to insurance premiums".

If we return to the form for working with RSV-1 and select the line “Pack of sections 6 RSV-1” here, we will see that a list of employees with the amounts of earnings and accrued contributions has appeared below. These are the data that fall into the "Individual information" (section 6).

Double-clicking on the line with an employee opens the form for editing section 6 of RSV-1 for this employee. If necessary, all the information here can be edited manually: change the amounts, add new lines.

The tab "Section 6.8 (experience)" of the same form reflects information about the employee's experience. If a sick leave was entered on it, then the period of illness is automatically displayed here with the code VRNETRUD. This section is also available for manual editing. For example, if an employee, by agreement with the management, was granted leave “without pay”, you should add lines here and indicate the required vacation period by selecting the desired code in the “Calculated length of service” section.

If necessary, such data as periods of work in special conditions or on a preferential position are also filled in. In the case of work in conditions of "harmfulness", section 6.7 is filled out.

Another possibility that allows you to edit the seniority of employees is the link "Experience" in the form of working with RSV-1:

Clicking this link opens the seniority editing form in the form of a list of employees. This form contains, among other things, columns for information on the appointment of an early pension. Changes made to seniority must be saved using the corresponding button.

The finished RSV-1 report can be printed on paper or downloaded from 1C as a file in PFR format. It is possible to check the correctness of filling out the report both using the check built into 1C and third-party programs.

The workplace "Quarterly reporting to the Pension Fund" also allows you to create a corrective form RSV-1 and load sets of forms into the program from reporting files.

Starting with version 3.0.43 and higher, the 1C:Accounting 8.3 program also generates a monthly SZV-M report (it is available in the "References and Settings" subsection of the "Salary and Human Resources" section of the program).

Source: programmer1s.ru

To automatically generate RSV-1 in 1C 8.2, you must perform the following steps:

In order to generate a printed form RSV-1 in 1C 8.2 Accounting, you must perform the following steps:

How to check the correctness of filling out the report in the FIU in the form of RSV-1 in the program 1C 8.2 Accounting is considered in the form of step-by-step instructions.

At the first step, information indicators are formed about the taxpayer, about the reporting period. Sample title page Form RSV-1 is presented below:

In the second section of the RSV-1 form, the calculation is made, established for the taxpayer.

In the line Base for calculating insurance premiums for compulsory pension insurance (lines 240 and 241) - the base is calculated by age:

In the line Accrued insurance premiums for compulsory pension insurance, contributions are calculated: insurance and funded part (line 250, line 251), if their amount is more than the maximum base value (line 252) according to the formula: contributions.

In the line Amount of payments and remunerations, in favor of individuals (p. 271) - the amounts of payments by months in the reporting period (columns 4-6) and the total cumulative total (column 3) are prescribed. Filling is similar to the indicators of lines on the OPS (lines 201 + 202 + 203 are summarized).

In the line Base for calculating insurance premiums for CHI (p. 275), the base is calculated according to the formula (p. 271 - lines 272 - 273 - 274).

In the line Accrued insurance premiums for compulsory health insurance, contributions to the FFOMS are calculated according to the formula: Amount of contributions = Base for contributions * Tariff for contributions.

You can also reconcile the amount of contributions with the balance sheet on the credit turnover of accounts 69.03.01 "Federal Compulsory Medical Insurance Fund". Similarly, you can check the calculations for all columns in the context of the months of the period:

An example of filling out Section 2 of RSV-1:

The first section of the RSV-1 form calculates the accrued, paid contributions for compulsory pension and medical insurance, and also indicates the balance on them.

In the line Accrued insurance premiums since the beginning of the reporting period (p. 110) - the total amount of accrued premiums on a cumulative basis since January 01. The data in the line must match:

In lines 111, 112, 113 - the amounts of contributions accrued for the previous three months are entered. The data in the lines must correspond to the data from section 2 columns 4, 5, 6:

Line 114 reflects the amount of insurance premiums for the last three months of the reporting period, which is determined by the formula (lines 111 + 112 + 113).

In line 130 - the total amount of insurance premiums payable, which is determined by summing lines 100 + 110 + 120.

In line 140 - you need to indicate the amount of payment of contributions on an accrual basis from January 1 to the reporting date. The data in the line must match:

In lines 141, 142, 143 - you need to enter the amounts of contributions paid for the last three months. The data in the lines must correspond to the amounts of payment of contributions on a monthly basis (debit turnover on accounts 69.02.1, 69.02.1, 69.03.1);

In line 144 - the summation of lines 141 + 142 +143 is reflected.

Sample filling RSV-1 Section 1:

The procedure for filling in the payment order fields for monthly payment of insurance premiums to the Pension Fund of the Russian Federation (insurance part):

In field 104 "KBK" you need to enter the budget classification code for the contribution paid.

Attention! The CBC is an important requisite; if it is incorrectly indicated, the insurance premium will not be correctly credited and will entail the accrual of penalties.

In our example, the following BCFs are indicated:

Details for the payment of insurance premiums must be found in your pension fund or on the official website of the pension fund. For Moscow, you can use the site www.pfrf.ru/ot_moscow.

To automatically generate a payment order in 1C 8.2, you can use the processing Generating payment orders for taxes through the Bank menu:

Full list of our offerings:

Quite recently, the next period for reporting to the FIU has begun, and therefore I decided on the pages of this site to talk about how the preparation of the regulated RSV-1 report in 1C ZUP edition 3.0 is carried out.

This article will focus primarily on the sequence of report preparation in 3.0 and, of course, on some features that should be checked and taken into account for the correct formation of RSV. In this regard, I think the article will be useful for both beginners and experienced users of the ZUP 3.0 program (By the way, for novice users of edition 3.0 or for those who want to learn how to eat useful material).

For those who have not yet implemented and are still working in ZUP 2.5, there is also similar material, which can be found by clicking on. I published it a little earlier, but it is still relevant today.

✅

✅

✅

To begin with, I will tell you in general how to prepare a regulated report in the FIU.

Everything related to regulated reporting (not only in the FIU, but also in the FSS, IFTS, etc.) can be found in the main menu section "Reporting, information". To generate a RSV-1 report, you must use a specialized workplace, which is launched from this section at the link "Quarterly reporting to the Pension Fund".

The main thing here is to use this particular worker, and not the 1C-Reporting magazine (in the picture a little higher). Of course, it will be possible to create RSV-1 from it, but this report will not contain individual information, they simply will not be filled out with this method of creation. Therefore, it is necessary to use the workplace "Quarterly reporting to the FIU".

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Before you can start creating a report for the current quarter, you must set the status to "Submitted" for the report for the previous quarter, if this has not already been done. To do this, use the “Set status” menu item of the workplace and select the “Sent” status.

After that, you can use the button “Create a kit for _ sq. 201_". A form will open in a new window and it will take some time to fill in the information. After completing this process, we will receive two or more bundles of information.

The topmost pack corresponds to the general sections of RSV-1 (sections 1-5). If positioned on this line, then below for us is the main information from the general sections. To open and view / check these sections directly you need to click on the line "Sections 1-5".

If you position yourself on the bottom line (this is a pack of individual information - section 6), then below we will see a list of all employees included in this pack. Here we will be able to see for each of its base and calculated insurance premiums.

Of course, all individual information for each individual can be viewed directly in RSV-1, but it will be quite inconvenient to scroll through all this “footcloth” and analyze the information in this form.

This window has three tabs. In the first - "Sections 6.4 (earnings), 6.5 (contributions)"- you can get acquainted with information about the monthly earnings of an employee in the current quarter, as well as about the accrued contributions (in the picture above).

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

In the second tab called "Section 6.7 (earnings of harm.)", provides information on earnings, which is subject to additional contributions for harmful and difficult working conditions. Naturally, this tab is filled out only for employees whose position provides for such contributions.

And finally the third tab - "Section 6.8 (seniority)". This reflects the employee's length of service for the past quarter. At the same time, the program itself knows how to break periods, if, for example, there was a sick leave or vacation at its own expense. And for pests, it is important to indicate correctly in the position special working conditions code and list item code so that the relevant fields can be automatically loaded in the seniority.

To refill the report, use the button Refresh -> Refresh Full.

If for some reason you have made manual changes to the report, but you need to update it, then you can do this without losing the corrections - "Update with corrections." By the way, employees who have manual fixes will be reflected in bold.

Next to the "Update" button, you can see the button "Add". It allows you to manually add another batch of sections to the reporting, for example, corrective. But I am again I don't recommend doing it manually.. We have a smart program that knows better how to do it. And in order for it to automatically create adjustments, it is enough to reflect in the database the fact of additional assessment of contributions for previous periods, or to make a correction for any other situation in connection with which an adjustment is required. The program will track this and create a pack itself (to understand how this is done, you can read the examples of articles about adjusting from).

However, there is a useful button here "Add" -> "Additional files". In my practice, there were situations when the FIU required clarification on some situations in a regular Word file. It is these additional files that are added to the report by this button.

Further, it all depends on what program you use to send the report. If it is a third party program, then from 1C the report must first be unloaded using the button of the same name in the workplace menu. When uploading, the report is checked internally and if there are errors, the program will tell you about it. The report is then loaded into the report sender.

There is another option, more convenient. You can send a report directly from 1C. And confirmation of the accepted reports will also come in 1C. Quite convenient and, by the way, cheaper. Connection conditions for different regions are different, so if you are interested in knowing the details, you can . I will gladly advise you.

That's all for today, if you have any questions about preparing reports in ZUP 3.0, you can write in the feedback form or.

To be the first to know about new publications, subscribe to my blog updates: